Impact

Transforming Rhode Island through Impact Investing

Twenty-five years ago, the Rhode Island Foundation made one of its first impact investments through a $9M revolving loan fund to boost the commercial and residential vibrance of the Downcity Providence neighborhood.

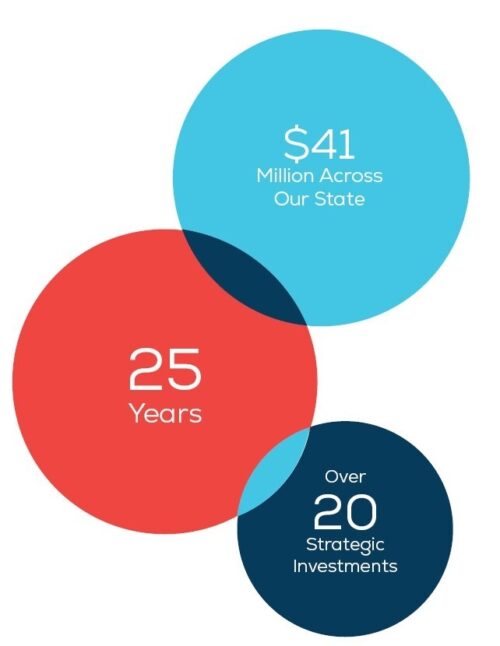

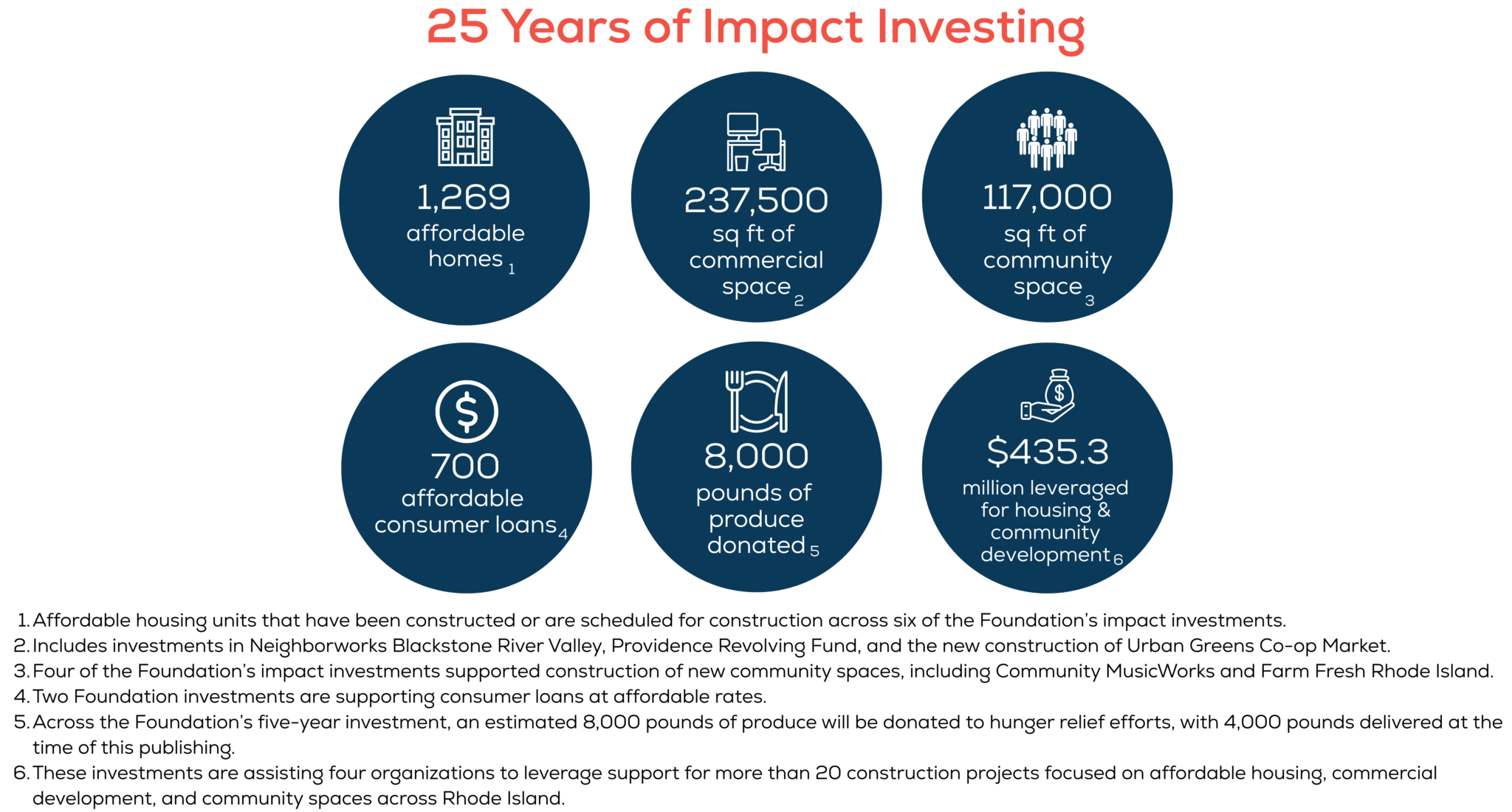

This investment kicked off what has now become a transformative approach to infusing capital into the community. Over the past quarter century, our impact investing strategy has evolved into a comprehensive program that has deployed more than $41 million across our state. More formally established in 2017, the Foundation’s Impact Investing program encompasses over 20 strategic investments, ranging from loans, lines of credit, and an equity stake, that have touched virtually every sector of Rhode Island's economy.

Since the program’s formal inception, over $20 million in shared capital has directly impacted thousands of lives while generating modest financial returns intended to cover management costs and keep pace with inflation. The program has also realized a remarkably successful repayment rate of 100%.

The Foundation’s strategic investments have helped create essential infrastructure, facilitated additional community investment, and supported hundreds of affordable housing units. Families throughout Rhode Island now have improved access to healthcare services and nutritious food, small businesses in underserved communities have found pathways to growth, and environmental initiatives are creating a more sustainable future for our state.

The Impact Investing Approach

While traditional philanthropy operates on a model of giving - distributing grants to nonprofits without expectation of financial return - impact investing takes a different approach.

Impact investing is the practice of investing in companies, nonprofit organizations, and managed funds, with the intention to generate measurable social and environmental impact, alongside a financial return. These investments may be structured as loans, lines of credit, guarantees, or equity stakes. Historically, the Foundation’s investments have ranged from $200,000-$2M for terms of 1-10 years. The Foundation offers capital at well below market rates, with an overall portfolio target return of 3%.

As a complement to grantmaking, this model enables the Foundation to better align its financial investments with its mission and the community priorities outlined in its Five-Year Action Plan, and creates a powerful multiplier effect, allowing philanthropic dollars to work repeatedly as they are repaid and reinvested.

Impact Investing Portfolio 2000-2025

Learn more here about the projects we've supported.

How Capital Creates Change

The Foundation’s impact investments have created sustainable, meaningful change across Rhode Island communities. The following examples illustrate how strategic capital investment can address community need while generating both social and financial returns.

NeighborWorks Blackstone River Valley, PCF Development, and the Providence Revolving Fund

Housing remains one of Rhode Island's most pressing challenges.

In 2020, NeighborWorks Blackstone River Valley (NBRV) received a $975,000 revolving loan from the Foundation. Based in Woonsocket, this development corporation collaborates with residents, businesses, and community partners to create affordable housing opportunities throughout Northern Rhode Island. With this infusion of capital, NBRV’s Northern Rhode Island Community Development Revolving Fund was established, offering affordable predevelopment and acquisition loans for diverse projects—from multi-family housing and single-family homes to mixed-use developments, community facilities, and neighborhood initiatives. The impact of this support has been substantial, catalyzing an additional $176M in investments and leading to both new construction and rehabilitation of existing properties, producing 35 homeownership units and more than 350 rental apartments.

More recently, the Foundation provided an acquisition loan to enable PCF Development, a nonprofit community development program that works to advance and manage affordable housing in Pawtucket and Central Falls, to purchase a 30,000 square foot site that will be used to construct 25-30 new affordable housing rental units. And another recent investment of $2M in the Providence Revolving Fund’s Opportunity Investment loan pool will support residential and commercial development in Providence and surrounding areas for low-to-moderate income communities.

The Foundation has consistently prioritized housing accessibility and affordability, recognizing that housing is fundamental to family stability, educational outcomes, health, and economic opportunity. While meaningful progress has been made, the housing crisis persists, demanding innovative solutions and community-wide commitment. The Foundation maintains its focus on this vital sector and continues its work to support and invest in creating more places for Rhode Islanders to call home.

Capital Good Fund

Many Rhode Islanders lack access to fair financial services, often falling prey to predatory lenders during times of crisis. The Foundation's 2020 investment in the Capital Good Fund, and our current support of the organization’s DoubleGreen Solar Fund, back innovative alternatives to high-interest payday loans and fair-interest financial products for low-income borrowers.

The Foundation's investment came at a critical point in our development. Their support allowed us to scale our impact and reach more Rhode Islanders who had been shut out of the traditional financial system.

- Andy Posner, Founder and CEO of the Capital Good Fund

This partnership has helped to provide equitable consumer loans to 700 low-income households, assisting Rhode Island residents experiencing financial insecurity address immediate needs while building credit histories that open doors to mainstream financial services. It represents an approach to economic justice that combines assistance with long-term pathways to financial stability.

Revive the Roots

In 2022, the Rhode Island Foundation provided bridge financing to help Revive the Roots, a local nonprofit, purchase the historic Mary Mowry House and its surrounding 5.27-acre property in Smithfield. The investment was structured to bridge pledges receivable, enabling the organization to secure this property for their headquarters and continue their community programming.

Today, Revive the Roots maintains 40 community garden plots where 60 local growers cultivate fresh produce. The organization expects to donate approximately 8,000 pounds of produce for hunger relief efforts over the life of the loan, with 4,000 pounds already donated, creating a sustainable model that combines historic preservation, environmental stewardship, and food security.

This investment exemplifies how the Foundation's impact investing approach can preserve cultural assets while addressing immediate community needs—creating spaces where Rhode Islanders can connect with their heritage, the land, and each other.

The Public's Radio

To ensure continued access to quality journalism, the Foundation made a $1M strategic investment loan in 2017 to enable the station to purchase and relocate its FM signal, helping expand its audience and programming. In the first year, the station reported a 7% increase in listenership over the prior year, reaching 1.3 million listeners.

The Foundation's investment in The Public's Radio's digital infrastructure, allowing them to meet audience needs across multiple platforms, has helped ensure Rhode Islanders continue to have access to trusted local news—an essential component of civic engagement and community connection.

Farm Fresh Rhode Island

In 2019, the Foundation provided a $1.9 million impact investing loan to Farm Fresh Rhode Island (FFRI) to begin construction on its new food hub, a 60,000 square foot building that serves as the organization’s headquarters and a center for food and agriculture in the state. This investment addressed a gap in requested tax credits and received tax credits to make the project viable.

Completed in 2020, half the structure now houses FFRI’s operations and programs, including its popular wintertime farmer’s market, and the remaining space is leased to food- and farm-related small businesses.

Farm Fresh Rhode Island has become a cornerstone of the state's local food system, connecting farmers with consumers and creating jobs in the food economy. Through the Foundation’s investment, as well as the support of community partners, the organization expanded its ability to help local farmers extend their seasons and increase revenue while providing fresh, healthy food to Rhode Island communities, particularly those with limited access to nutritious options.

The Next 25 Years

Although Rhode Island continues to make measurable progress, our state faces persistent challenges that require collective action. In neighborhoods across the state, the Foundation’s investments have helped transform vacant properties into affordable housing, yet the crisis continues to affect too many. Former industrial zones have evolved into innovation hubs where local entrepreneurs build businesses that address community needs, though economic opportunity gaps persist in many areas.

Despite progress, many Rhode Islanders still struggle to find affordable housing, economic opportunity remains unevenly distributed, effects of climate change grow more urgent, healthcare access is inconsistent, and educational outcomes still vary dramatically by zip code.

With a proven record of success, in the years ahead the Foundation's evolving impact investing strategy will continue to address these community priorities.

Building Rhode Island's Future Together

The Rhode Island Foundation has demonstrated that financial investment and positive social impact can go hand in hand. As we celebrate the progress we've made, we also extend an invitation to join us in our work to create a Rhode Island where everyone has an opportunity to thrive.

The Foundation's Impact Investing program welcomes partners who share our vision for a more equitable, vibrant Rhode Island. Our experienced team conducts due diligence, carefully structures opportunities to maximize both financial and social returns and provides ongoing guidance to the organizations and initiatives we partner with through impact investments. Together, we can deploy capital in ways that address our state's most pressing needs, while creating sustainable models for long-term prosperity.

As we look to the next 25 years, we remain committed to Rhode Island and the belief that strategic, patient capital investment can create transformative change.

Organizations interested in learning more about the Foundation’s impact investing work, please contact Ricky Bogert, Director of Impact Investing and Housing, at (401) 427-4011 or rbogert@rifoundation.org. Donors interested in partnering with the Foundation may contact Daniel Kertzner, Senior Philanthropic Advisor, at (401) 427-4014 or dkertzner@rifoundation.org.